Zerodha Coin Mutual Fund:

Zerodha is a popular online discount broker in India. Zerodha is the first broker to offer Direct Mutual Funds through its platform ‘Zerodha Coin’. Zerodha Coin platform is available on the web as well as the Mobile App (Android & iOS) version, free of charge to all Zerodha customers.

Zerodha Coin offers investors direct mutual funds from several reputed Asset Management Companies. You will get all popular AMCs like Axis Mutual Fund, BNP Paribas, DSP, and Edelweiss and many others. Investors can invest in a range of different types of mutual funds as per below:

- Equity/Debt/Liquid or Hybrid Funds

- Large /Mid/Small Cap Funds

- ELSS (Equity Linked Savings Schemes)

- Fund Of Funds

A Demat account with Zerodha is mandatory to use the Coin platform to get the credit of all the Mutual fund units to the Zerodha Demat account. It makes it convenient for Zerodha customers to trade in stocks, currencies, derivatives, and mutual funds from one trading account and hold it on a single Demat account.

Zerodha Coin Features

- Allows investors to invest in Direct mutual funds.

- Easy to Start, Stop, or Modify your SIP investment any time you want.

- Provides consolidated statement with visualizations, profit and loss and much more.

- Completely online services.

- Easy and simple navigation.

- e-Mandate facility available.

Zerodha Coin Charges

Zerodha offers Direct Mutual Fund investment services for free. The Zerodha Coin mutual fund charges are zero. Here is the detail of the charges:

| Head | Charges |

|---|---|

| Zerodha Coin Account Opening Fees | Zero |

| Zerodha Coin AMC Fees | Zero |

| Zerodha Coin Brokerage Charges | Zero |

| Zerodha Coin Commission | Zero |

| Zerodha Coin DP Charges | Zero |

| Other Charges | No Hidden Charges |

Zerodha Coin Account Opening

You need to have a trading and Demat account with Zerodha to access Zerodha Coin. Zerodha offers online and paperless account opening. You can also download the account opening forms from the Zerodha website and submit the physical copies of duly filled forms and documents to the Zerodha Head office. Click here to read the details on Zerodha Account Opening.

Note: You do not require a separate account for mutual funds. A trading and Demat account with Zerodha by default allows you to access Zerodha Coin.

Zerodha Coin Login

Zerodha Coin login is the same as of Zerodha Kite. There is no separate login ID for Zerodha Coin. You need to enter the same Zerodha login ID and credentials as required for Zerodha Kite.

The login credentials are provided over email post the account gets opened with Zerodha.

Zerodha Coin App

Zerodha offers to invest in mutual funds via Coin web and Coin mobile app. Zerodha Coin is a proprietary platform for mutual fund investments. The Coin mobile app supports Android and iOS systems (iPhone and iPad both).

The Coin app is available for free on the Google play store and App store.

Steps to download Zerodha Coin App

- Visit Google play store/ App store.

- Search for ‘Coin by Zerodha’.

- Click on Install to download the app.

- Login with Zerodha Kite credentials to invest.

Zerodha Coin cut-off time

The Zerodha cut-off time for mutual fund orders is an hour earlier than the SEBI cut-off time.

Zerodha Coin timings

| Fund Type | Liquid and Overnight Schemes | All other funds |

|---|---|---|

| Zerodha Coin Purchase/Buy Cut-off | 12.00 PM | 1.30 PM |

| Zerodha Coin Redemption/Sell Cut-off | 1.30 PM | 1.30 PM |

Zerodha Coin order processing

Investing in mutual funds with Zerodha is simple, easy and fast. Zerodha Coin allows SIP and lumpsum investment.

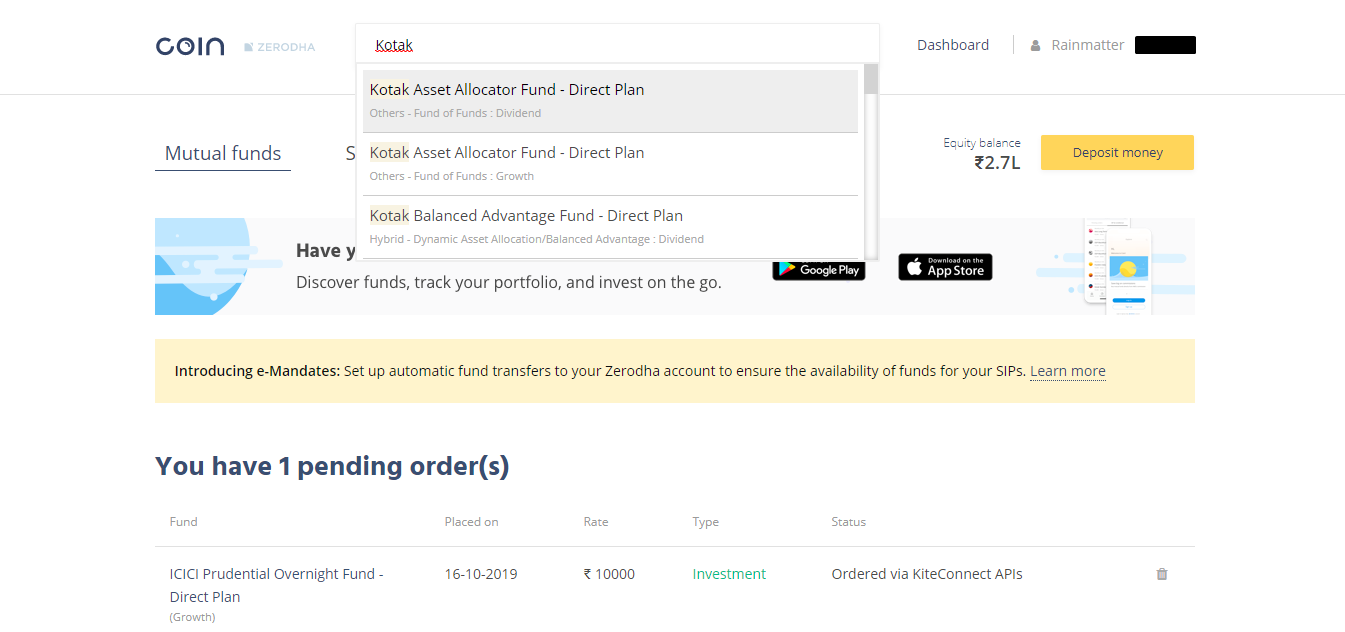

Steps to buy mutual funds from Zerodha Coin

- Login to the Coin platform.

- Look for the search bar available at the top of the page.

- Type the name of desired fund or fund house.

- Click on Buy for lumpsum investment and SIP for SIP investments.

- Enter the investment details as per selected option.

- For lumpsum (buy) investment, enter the Investment amount.

- For SIP investment, enter/select:

- Frequency of investment.

- Instalment amount.

- Automatic set-up (optional in case you wish to increase your investment amount each time by specific %)

- Click on Buy for lumpsum options and Start SIP for SIP investments.

Steps to Buy Mutual Funds in Zerodha Coin

Steps to SIP Mutual Funds in Zerodha Coin

Zerodha Coin demo

Zerodha Coin Pros & Cons

Zerodha Coin Benefits

Investing in mutual funds using Zerodha Coin provides you with a range of benefits listed below:

- Unlimited free investments with no commission charged on your investment.

- Facilitates to buy Mutual Funds directly from 40+ Asset Management Companies (AMC).

- Allows lump sum and SIP investments.

- Allows to increase or lower your SIP investment amount as per your need.

- Invest online at your convenience.

- One trading account with Zerodha offers to invest in multiple securities.

- All investments like stocks, bonds and mutual funds get held in one Demat account.

Zerodha Coin Disadvantages

Zerodha coin suffers from a couple of disadvantages like,

- A Demat account with Zerodha is mandatory for mutual fund investments.

- Zerodha does not provide mutual fund recommendations or research services. Thus, difficult for beginners to choose the right fund.

- Early cut-off time for buying and redemption of mutual funds.

Zerodha Coin Customer Care

Zerodha does not have a separate customer care support for Coin. You can reach out to Zerodha support for any assistance in reference to mutual fund investments. Alternatively, you can also raise a ticket through the Zerodha support portal using the Zerodha Kite login.

Zerodha Coin Support (Zerodha Support Contact)

- For general queries : 080 4718 1888 / 1999; 080 7190 9543 / 9545

- For account opening : 080 4719 2020 / 080 7117 5337

Zerodha Coin e-Mandate

Zerodha Coin provides an e-Mandate facility to its customers that allow investors to fund their SIPs on time without the need to remember to transfer manually on the SIP scheduled date.

Zerodha Coin’s e-Mandate feature allows investors to schedule automatic transfers from their bank account for their SIPs in two simple steps.

(i) Register an e-mandate on Console for the bank account linked with your Zerodha account.

(ii) Schedule transactions to automate fund transfer for the SIP.

To register for an e-mandate, your bank should support NACH e-mandates.

Zerodha Coin Exit Load

The exit load is the penalty levied by the fund houses if an investor exits/redeems the mutual fund early or within the specified time frame. The exit load charges differ from fund to fund. Some funds do not have any exit load.

Zerodha Coin displays the Exit Load for each fund on the fund detail page. For example, if a fund has an exit load of 1%, then on early redemption, 1% of the latest NAV gets deducted from your redemption amount.

Zerodha Coin NFO

Zerodha offers to apply online in NFO through the Zerodha Coin website. Currently, the NFO application feature is not available in Zerodha Coin mobile app. Zerodha is working on the NFO order placement feature to be added soon to the Coin app.

Conclusion

Zerodha Coin is safe online platform to invest in direct mutual funds. Zero commission and charges in Zerodha Coin help investors earn more (up to 1.5%) than in regular mutual funds. The platform also allows Zerodha customers to consolidate all their investments in one place or Demat account and manage it easily.